Software for debt securities evaluation and bond portfolios risk analysis

Over the last 15 years ANALYSIS has developped applications and services dedicated to the interest rate instruments evaluation and bond portfolios risk management:

PromotioWin for analysis and evaluation of mark-to-market debt securities (yields, repos , postion-keeping, fair price evaluation)

PromotioWin for analysis and evaluation of mark-to-market debt securities (yields, repos , postion-keeping, fair price evaluation)

RISK

for bond portfolios risk management (money-market zero-coupon curve

and government bonds term structures historical data,

transactions-based portfolio management and comprehensive tools for evaluating portfolio VaR).

RISK

for bond portfolios risk management (money-market zero-coupon curve

and government bonds term structures historical data,

transactions-based portfolio management and comprehensive tools for evaluating portfolio VaR).

ANALYSIS

has currently one of the most extensive database of corporate banking

bond issues and software capable of analyzing in detail the

characteristics of bonds and calculate all the main indicators of risk

and profitability. The software applications also have forms that

are appropriate to provide fair assessments on price structures with

simple plain vanilla or optional features.

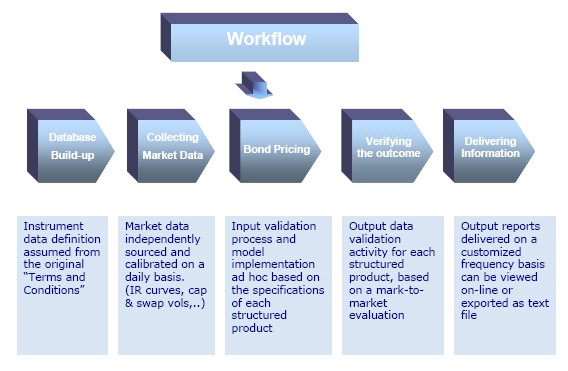

Fair Price independent evaluation service

For evaluating fair value of complex

interest rate such as structured bonds, volatility products and

swaptions or hybrid instruments such as index/equitycurrency/commodity

linked, ANALYSIS provide a specific service delivered through an

Application Service Provider interface.

ANALYSIS only for this specific service also makes use of external partnerships in order to cover a broad spectrum of needs.

The service, through a simple Web interface, allows the customer to take advantage of the following two modules:

Displaying of portfolio holdings to facilitate the end-user in the validation process of each instrument terms and conditions assumed from the original Prospectus.

Displaying of portfolio holdings to facilitate the end-user in the validation process of each instrument terms and conditions assumed from the original Prospectus.

Displaying the price decomposition of each instrument also including an

optional component with the main coefficients of sensitivity (delta,

vega and rho)

Displaying the price decomposition of each instrument also including an

optional component with the main coefficients of sensitivity (delta,

vega and rho)

The theoretical approach used for the enhancement of price is based on

specific models (Libor Market Model, White Hull) made ad hoc and

calibrated based on the specifications contained in the "Terms and

Conditions" of each structured product.

|

Convertible bonds evaluation

Analysis is also a client service center in Italy for the Monis XL software, developed by SunGard - Monis division.

Monis XL

is the leading European software application in the evaluation of

convertible bonds, but can also cover a wide range of interest rate

instruments.

It 's a software dedicated to the most sophisticated players, easy to

use (Excel based) and advanced mathematical content. Monis XL

convertible bonds can develop very complex and so-called "hybrids" structures.

The form calculates all the core indicators for the analysis and for

the hedging of these instruments. SunGard Monis is also developing

other modules, always based on MS-Excel, dedicated to the evaluation of

equity / index / FX and interest rate derivatives.

Value-at-Risk (VaR) - Financial risk measurement service of securities and managed account portfolios

This evaluation service may include in the data stream, provided on the basis of indications of the Customer, the following risk measures:

measuring the volatility and VaR of the overall portfolio

measuring the volatility and VaR of the overall portfolio measuring the volatility and VaR of the of each individual securities (portfolio holdings)

measuring the volatility and VaR of the of each individual securities (portfolio holdings) measuring the contribution and marginal VaR of the portfolio holdings

measuring the contribution and marginal VaR of the portfolio holdingsThe data stream may also contain the value of the estimated VaR over a holding period to be agreed with the customer, and finally a measurement of the risk profile .

This service could be automatically implemented for measuring VaR of all portfolios containing financial instruments listed below:

Bonds listed and unlisted (plain vanilla)

Bonds listed and unlisted (plain vanilla)  Funds,SICAV, ETF (EU harmonized)

Funds,SICAV, ETF (EU harmonized) Stocks traded in major markets (Europe, North America and Far East)

Stocks traded in major markets (Europe, North America and Far East)